Bank information provider TurboPass hopes to break into the franchised dealership market with a new product allowing retailers to review payroll data for prospective auto borrowers, Patrick Jarman, director of marketing and strategic initiatives, said this last month.

TurboPass’ business historically has involved helping auto shoppers easily share their bank account data with lenders and dealerships through an online tool accessible through a text message link. This allows the retailer or creditor to quickly verify the stipulation (“stip”) information, such as income, the lender checks before granting a loan. TurboPass says it’s able to cut a contract “in transit” — not yet funded — from days to hours. Dealers have requested more than 200,000 TurboPass banking reports in the past two years, according to the company.

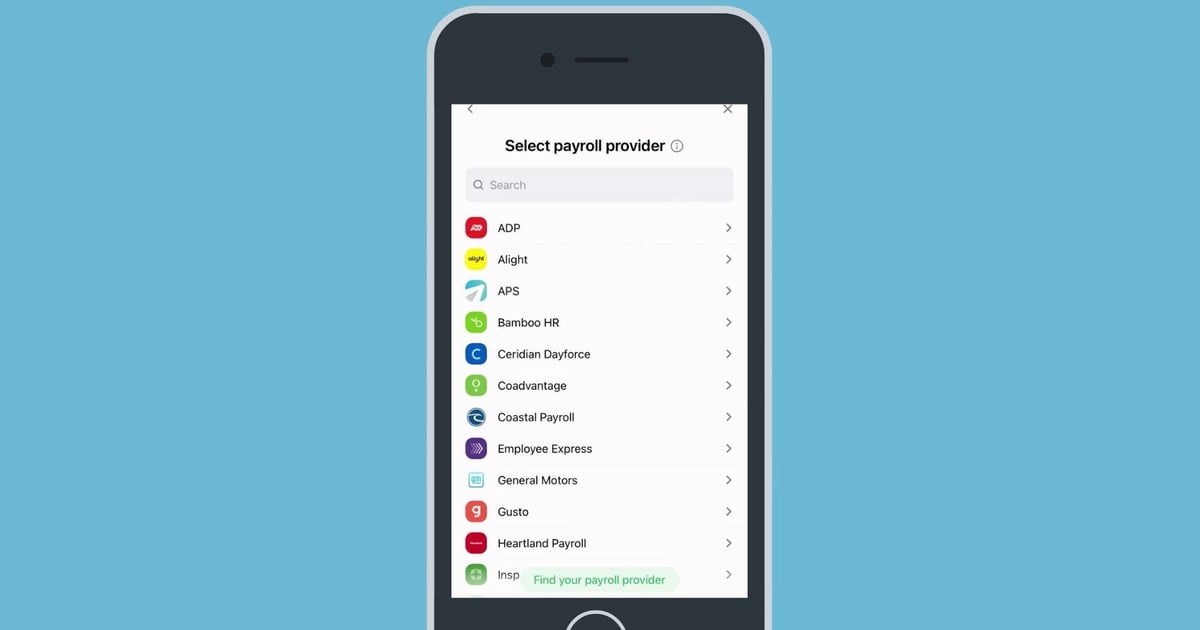

The company’s new PayStub Report option allows TurboPass’ dealers and lenders to receive information and verify creditworthiness straight from the consumer’s payroll provider (for example, ADP) through a similar mechanism. Workers often can log in and review data from their pay stubs on demand, and TurboPass leverages this capability to connect to the information and transmit it digitally, according to Jarman. Jarman said TurboPass PayStub Report can access data from 80 percent of the payroll providers in use among employers.

Jarman called the product the company’s biggest announcement in two years and said significant demand exists for such a feature, which TurboPass noted could help defend against fake pay stubs.

“It’s been great having another verification tool at the dealership to help speed up and improve the customer experience. It’s made our funding process a lot faster,” URboss Auto dealer principal Greg Skurkovich said in a statement. “We require that TurboPass banking or PayStub reports are used on every car deal.”

TurboPass PayStub Report launched nationally Oct. 3.

Jarman told Automotive News the company has traditionally served lenders — including used-vehicle loan giant Westlake Financial, which has been involved in PayStub Report testing — and independent dealerships. Franchised dealers typically haven’t been as interested in TurboPass’ banking reports, Jarman said, though he noted Toyota of Hollywood in Florida was a heavy user. But he anticipated the pay stub validation capability would send more franchise business TurboPass’ way.

Toyota of Hollywood finance manager Maxzuel Martinez told Automotive News the dealership recently received access to the pay stub tool.

Martinez said he’s seen an example of the output and “you get a really nice report.” It’s not a pay stub, but it verifies the same information, he said.

Westlake acquisitions Senior Vice President Kyle Dietrich said in a statement that dealers, borrowers and lenders would “experience a frictionless paper-free funding process when using these reports.”

Banks are using customer-provided connections to personal financial information for mortgages, Santander Consumer USA Head of Originations and Executive Vice President Betty Jotanovic told a Fintech Nexus webinar audience Oct. 12. But it can be challenging to use for auto lending, particularly among prime consumers, she said. Borrowers can be unwilling to participate for that use case.

“It’s not customary,” she said. “[Auto lending is] typically a stated-income business.”

It’s an option for subprime lending, according to Jotanovic, but issues can arise when a borrower has streams of income or an employer that aren’t captured in such a database.

A reluctance to use such a tool doesn’t necessarily stem from the customer, Jotanovic said. A dealership arranging indirect auto loans for customers might be unwilling to send the business to a lender requiring a stipulation.

“It’s really the dealer deciding,” Jotanovic said. If two lenders have similar interest rates and one wants a stip, the dealership might take the ‘path of least resistance,’ ” she said.