If Brian Godfrey could wave a magic wand, Pat Milliken Ford would have four more service technicians on the payroll.

The suburban Detroit dealership could keep that many additional technicians busy, said Godfrey, its president. Service sales, including parts for service operations, are increasing — up 15 percent year over year through September and exceeding levels seen before the pandemic in 2019.

Yet business could be even stronger, Godfrey said, if the dealership had the capacity to grab it.

With more help on the service drive, “it would put us in a position where we could go market ourselves for new business as opposed to kind of being on the defensive and trying to handle the business that’s coming in the door,” he said. “We’re doing the best job we can, primarily to take care of our loyal customers, but we’d like to go out there and be more aggressive to bring new business in.”

Across the industry, franchised dealerships’ service and parts businesses are growing, buoyed by an inventory shortage that has prompted some consumers to hold on to their vehicles longer, experts and economists told Automotive News. That is contributing to bigger-ticket repairs to keep vehicles on the road and, along with inflation, is helping to lift service revenue and gross profit.

Franchised dealerships last year recorded $125.57 billion in total parts and service sales, according to the National Automobile Dealers Association’s full-year dealership financial report. That’s an improvement from both 2019 and 2020, when many dealerships’ operations were affected by shutdown orders early in the pandemic. The rising trend held through June of this year, when NADA reported total parts and service sales of $68.89 billion halfway through 2022.

Yet even as dealers remain bullish on their fixed operations, service and parts are not without challenges. Some dealers are concerned about the long-term effects of electrification and over-the-air software repairs that don’t require a customer to bring their vehicle to a dealership for service.

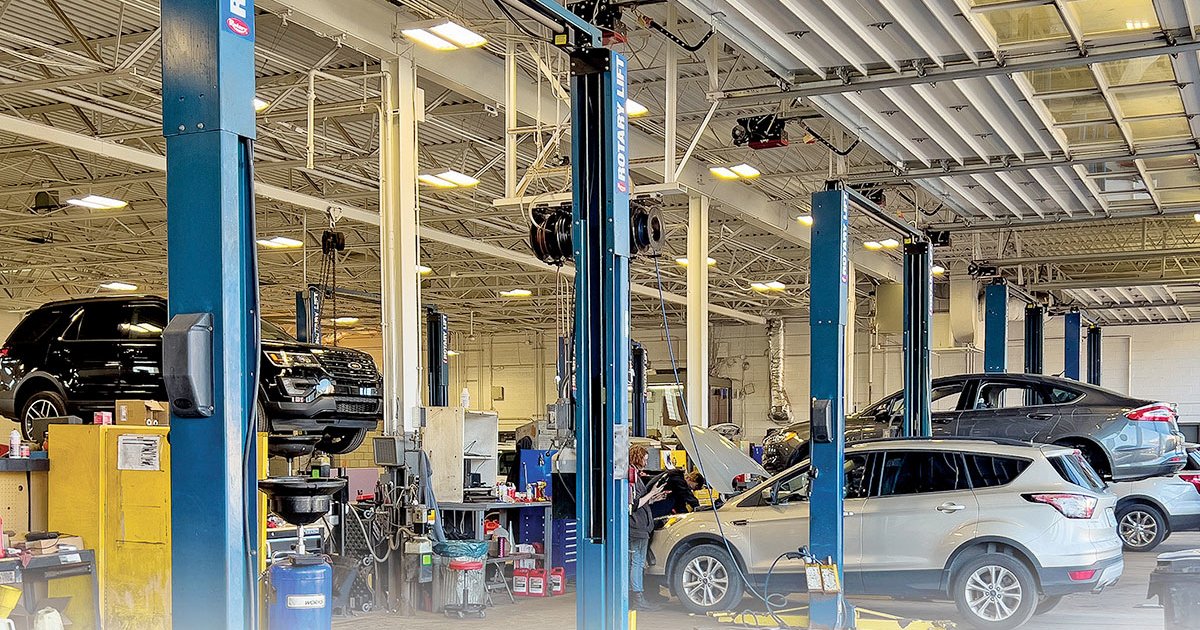

For now, a shortage of technicians and difficulty obtaining parts to complete jobs have caused capacity issues in the service drive, which limits some dealerships’ ability to meet high customer demand, Jonathan Smoke, Cox Automotive’s chief economist, told Automotive News last month.

“It’s not really that consumer demand is declining,” Smoke said. “It’s really the supply side that’s limiting their potential.”

Nevertheless, he added: “This is still incredibly strong, and I think it’s an area that dealers traditionally see a lot of resilience in, in a negative economic cycle.”

To that end, dealers are leaning on their service departments as a source of profit now and into the future, even as dealership profitability has soared under supply constraints that continue to crimp new-vehicle production. Some dealers are investing to boost capacity, train employees and add technology in their service departments to keep up with demand and improve customers’ experience with the process, in hopes of retaining more of them for future service and sales. It is estimated in the industry that once a new-vehicle warranty expires after three years, about 70 percent of customers go somewhere other than a dealership for maintenance and repairs.

Customer retention will be important, experts say, should inventory levels rise and begin to compress today’s inflated new-vehicle margins, as was the case before the pandemic. Ensuring service departments operate as efficiently as possible now is a hedge against any return to squeezed vehicle profits.

Rick Wegley, an instructor with NCM Associates’ NCM Institute who provides training for dealerships primarily related to fixed operations, said his clients generally are seeing higher customer-pay sales and gross profit on both labor and parts year over year.

Some, however, are experiencing flat or declining repair order counts, Wegley said. That means fewer customers are bringing their vehicles in for repairs today — a problematic scenario that could get worse, he said, because fewer new-vehicle sales today likely will translate into fewer vehicles in service lanes in three to five years once warranty periods expire.

“I have really grave concerns about that,” Wegley said.

And Cox Automotive said the drop in new-vehicle sales also has had an immediate impact on the number of all-important first service appointments at the dealership. Because of these factors, dealerships need to focus on retaining customers, adding capacity and shrinking appointment backlogs while business is good, Wegley said.

Adam Simms, CEO of Price Simms Family Dealerships, shares concern about the potential for less service business in coming years because of low sales today.

For now, Price Simms, with 14 dealerships in the San Francisco Bay Area, is enjoying strong service business. Through August, service sales were up 11 percent compared with the same period a year earlier, 33 percent from 2020 and 19 percent from 2019, group data shows. Customer-pay revenue through August was up 9 percent from a year earlier, helping to offset a 7 percent drop in warranty revenue.

“I’m very bullish on the small commercial fleet business,” Simms said. “I built a commercial fleet service center a few years ago, and it’s continuing to grow.”

Simms said he “can’t invest enough money” in service and parts. Even with ongoing issues obtaining parts, such as catalytic converters, he said investing in those operations is “the safest bet you could make” because the opportunity is so large.

The nation’s public dealership groups have seen robust parts and service business this year. All reported higher same-store parts and service revenue and gross profit in the second quarter and the first half of 2022.

The public auto retailers are expected to report their third-quarter earnings results as soon as this month.

Group 1 Automotive Inc., of Houston, reported same-store U.S. parts and service sales of $376.8 million in the second quarter, up 14 percent from a year earlier. Through the first half, same-store U.S. parts and service sales were $724.6 million, up 16 percent.

Group 1 increased its technician head count on a same-store basis by 12 percent in the second quarter, said Daryl Kenningham, then the retailer’s president of U.S. operations, on the company’s second-quarter earnings call in July. Kenningham in August was promoted to president and COO.

“The thing that we focus on is, how can we drive capacity in our shops?” Kenningham told analysts of Group 1’s customer-pay business, citing hours of operation, a four-day workweek and appointment availability as examples.

“We think it’s very important to have as many appointments available as possible,” he said. “That’s different than some in the industry will do. They will limit appointments. We tend not to do that. We’d rather be available. And then that puts a little more pressure on us to keep our capacity high and our staffing high and our hours of operation at a point that is convenient for customers.”

Asbury Automotive Group Inc.’s same-store parts and service revenue in its dealership segment reached $317.8 million during the second quarter, up 10 percent from a year earlier.

On a same-store basis, Asbury’s gross profit from customer-paid work increased 16 percent to $122 million, and wholesale parts gross profit rose 13 percent to $8.8 million. Same-store warranty gross profit dropped 23 percent to $20.6 million.

All together, Asbury’s parts and service gross profit, excluding internal vehicle work, rose 8 percent to $151.4 million. The company attributed much of the increase to consumers resuming pre-pandemic driving behavior.

“Parts and service remains strong,” CEO David Hult said on the company’s second-quarter earnings call in July. “The traffic is still great.”

Some dealership groups are investing to add capacity and efficiency while times remain good.

#1 Cochran Automotive in Monroeville, Pa., near Pittsburgh, is adding 27,000 square feet to its existing wholesale parts distribution center, CEO Rob Cochran said.

The dealership group centralized its wholesale parts business about five years ago, in part to support its own collision repair business, Cochran said. As the collision business grew and attracted more sales from independent body shops, the parts operation outgrew the space.

The wholesale parts business has annual revenue of roughly $45 million, he said. The group expects the business could reach $65 million to $70 million with more space.

“It’s going to put us in position to really extend and grow that wholesale parts” business, Cochran said.

Beyer Auto Group in Virginia was able to add two evening service hours at most of its stores after offering technicians the option to work four 10-hour days, rather than eight-hour shifts Monday through Friday, said Patrick Brooke, fixed operations director. That change has been in place for about a year, allowing the group to pick up an additional 180 to 200 repair orders per month.

The group, which sells Kia, Jaguar, Land Rover, Mazda, Subaru, Volkswagen and Volvo vehicles across five locations, also has stepped up its efforts to call customers who haven’t been in for service in several months or declined past service. It hired a company to handle calls and schedule appointments after hours and during busy times, which has made that process more efficient, Brooke said.

Service parts and labor gross profit was up by 21 percent through September compared with a year earlier, he said. It rose by 36 percent compared with the same period in 2020 and by 45 percent compared with the same period in 2019.

Brooke said his outlook on parts and service is good through at least the middle of next year. But that’s as far out as he said he is willing to project.

“I can’t tell you it’s going to be great for a couple years. I don’t know,” he said.

In recent years, few consumers would choose to repair older, high-mileage vehicles, said Godfrey, of Pat Milliken Ford in Michigan. Today, more are saying yes because their vehicles have increased in value or because they can’t find a satisfactory replacement.

The dealership began offering pickup and delivery to give service customers the ability to stay distanced during the pandemic. Since then, Godfrey said, the offering has become more about convenience. The dealership also has invested in software to help automate the process, he said.

All of those steps are efforts to improve the customer experience with service, he said, which in turn could lead to retaining customers for future service and sales.

“When things aren’t very good, whether it’s a recession or shortage of vehicles or whatever else, we quickly can’t make as much money in new and used cars,” Godfrey said. “The service department needs to be there to lean on.”

John Huetter contributed to this report.