CATL, China’s largest EV battery maker, saw its net profit spike 82 percent from a year earlier to 8.2 billion yuan ($1.2 billion) in the first half of this year.

The main driver of its profit surge was strong battery demand in and outside China, enabling its sales revenue to rally 156 percent to 113 billion yuan, the company said in its financial statement for the first six months.

It also attributed the profit growth to cost control measures such as signing long-term contracts with battery material suppliers and recycling battery materials.

In addition, it has “dynamically adjusted product prices through friendly negotiation with customers, which has to some extent passed on the pressure of raw material price increases,” CATL said.

In the first half, the Chinese battery giant shipped 71 gigawatt hours of batteries for EVs, a 116-percent jump from a year earlier, according to Korean market research firm SNE Research.

CATL, based in Ningde in east China’s Fujian province, has to date produced EV batteries in China only.

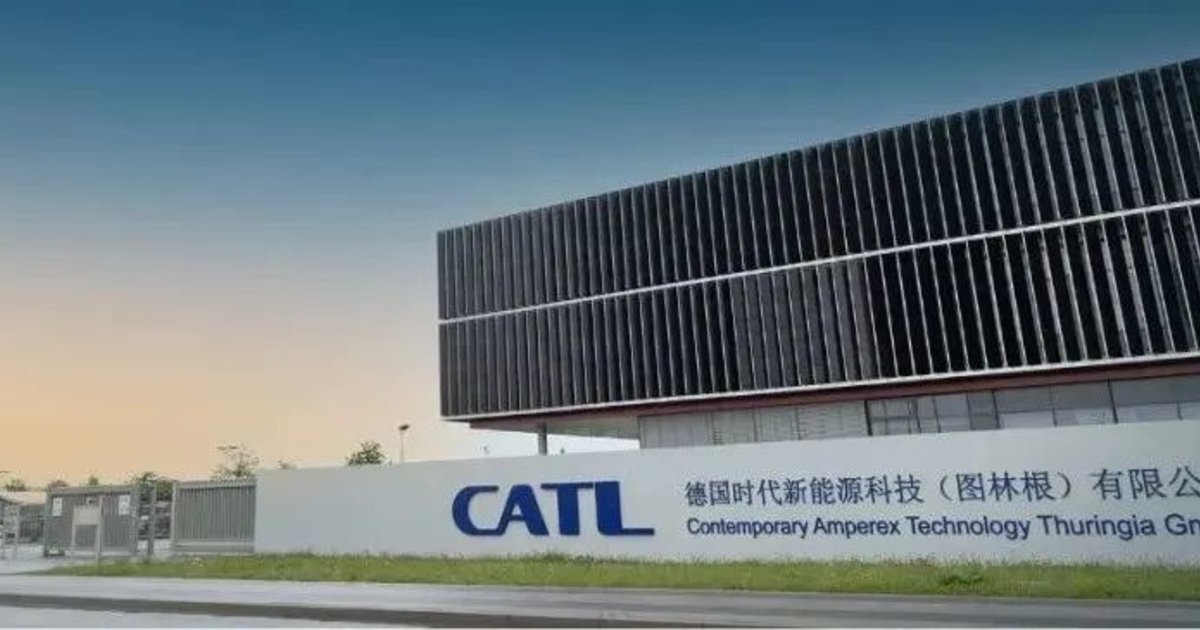

But the company is accelerating capacity building in Europe

It is about to complete the construction of a battery plant in the German state of Thuringia, which can build 14 gigawatt-hours of batteries a year. The factory is due to launch output before the end of the year.

Earlier this month, it announced a plan to start building a 100 gigawatt-hour plant in Debrecen, Hungary later this year.

In July, it signed a tentative deal with Ford Motor Co. to supply the automaker with batteries for EVs produced in China, Europe and North America.

As part of the deal, CATL will supply lithium iron phosphate battery packs for Ford’s North American Mustang Mach-E in 2023 and North American F-150 Lightning in 2024. But to date, the Chinese company hasn’t made it known whether the battery packs will be built in North America.