A Federal Trade Commission ruling that an auto dealership advertiser violated the Truth in Lending Act might surprise dealerships and consumers familiar with industry ads featuring fine print.

“This is probably a target-rich environment,” Michael Goodman, a partner at Hudson Cook law firm, said of the industry.

According to the 4-0 FTC decision to grant summary judgment against Traffic Jam Events and owner David Jeansonne II, hyping certain parts of a loan prominently while keeping other key aspects within fine print elsewhere on the ad could violate Truth in Lending and the related Regulation Z.

“Disclosures in tiny print, condensed text, or in difficult-to-find locations are not conspicuous under TILA,” Commissioner Christine Wilson wrote for the commission in its October opinion.

The FTC banned Traffic Jam and Jeansonne from the auto industry for 20 years after finding some of their dealership marketing violated Truth in Lending and the Federal Trade Commission Act. Traffic Jam and Jeansonne have appealed to the 5th U.S. Circuit Court of Appeals.

Traffic Jam and Jeansonne told commissioners they weren’t creditors subject to the Truth in Lending Act.

“David doesn’t loan anyone money,” Jeansonne’s attorney L. Etienne Balart of Jones Walker said Thursday.

Wilson and the other commissioners said the law extends to other parties in the case of advertising related to credit. Wilson’s FTC opinion said ads for closed-end credit such as auto loans must “disclose certain terms when ‘triggering terms’ appear in the ad.”

“Specifically, if an ad contains an amount or percentage of a down payment, the amount or number of installment payments, the amount of any finance charge, or the period of repayment, then the ad must also state additional terms such as the terms of repayment and the annual percentage rate (‘APR’), using that term,” Wilson continued. “These disclosures must be set forth ‘clearly and conspicuously.’ ”

Goodman said Regulation Z doesn’t define clarity or conspicuousness.

“There’s no type size requirement,” Goodman said. “There’s no placement requirement.”

But “if you use ‘mice type,’ you’re taking on some risk,” he said.

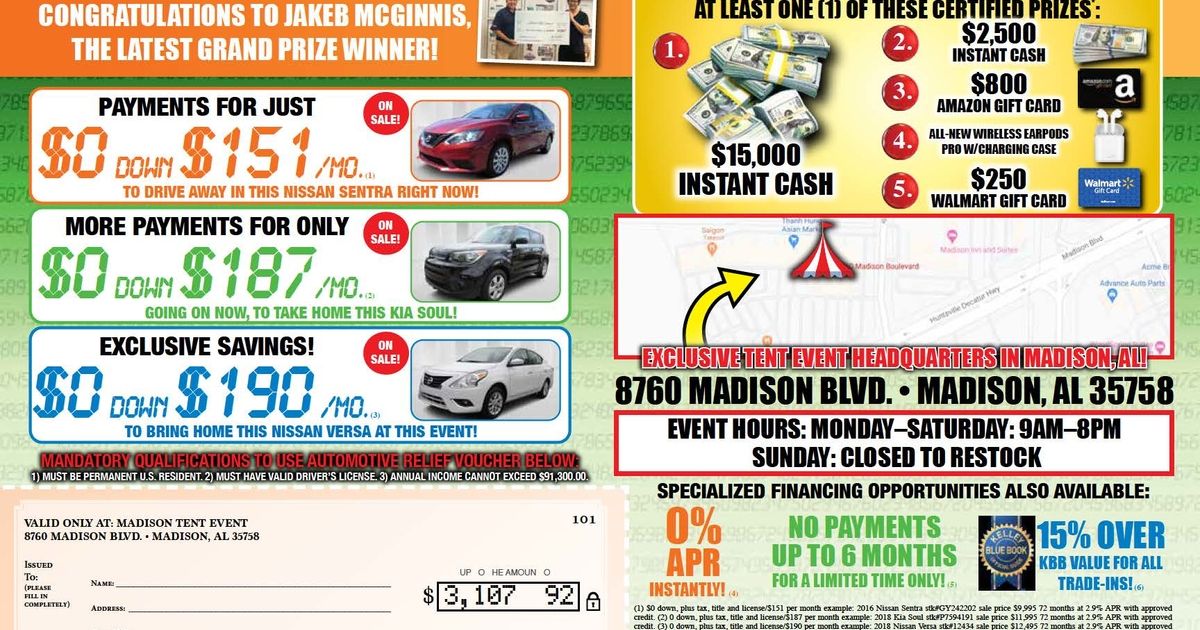

The agency’s motion for summary judgment against Traffic Jam and Jeansonne highlighted a prize giveaway mailer the company made for Landers McLarty Nissan Huntsville in Alabama. The dealership’s general manager has not responded to messages seeking comment.

Goodman said the FTC tends to bring Regulation Z actions “in bunches” the agency calls “sweeps” as a means of drawing attention to the issue. He said these occur about every three to five years.

“I would call this a more active area for the FTC enforcement than you might expect,” Goodman said.

The Landers McLarty Nissan ad featured a Nissan Sentra, Kia Soul and Nissan Versa next to large type stating “$0 down” and monthly payments of $151 for the Sentra, $187 for the Soul and $190 for the Versa. Footnotes directed the reader to a block of smaller type below and to the right of those elements stating these were 72-month loans with 2.9 percent interest rates.

“Respondents’ ad designs regularly follow this pattern: monthly payment amounts appear prominently in colorful type, while other credit terms such as APR and number of monthly payments appear, if at all, in a different part of the ad, in obscure, small type,” the FTC wrote in a court filing.

The FTC said some of Traffic Jam’s ads display the number of payments and APR on a different page than the monthly payment amounts, and some list a monthly payment but fail to feature the down payment or number payments.

“In some advertisements, financing with 0% APR or a low APR appears in colorful, prominent type, in close proximity to images of vehicles and monthly payment amounts — but the fine print states that the APR for the vehicles pictured in the ad is substantially higher,” the FTC wrote.

There’s not a clear standard on how likely the loan terms must be to be featured in an ad, according to Goodman. However, he noted an FTC study found when consumers see “as low as” or “up to” a particular amount, they feel they’ll receive the best benefit.

Goodman said he encourages clients who highlight a specific rate to ensure many consumers would qualify for it. He said he suspected many businesses that hype their lowest rate are only offering it to a few people.

“I think they’re running a risk when that’s their situation,” he said.

Goodman said some dealerships simply opt not to advertise qualities that would trigger Truth in Lending requirements. Others still wish to compete on price and include such information.

“That’s totally doable,” he said. Just make sure to meet Regulation Z conditions, he added.

One option is to advertise loan terms as a representative example and label it as such, according to Goodman. That is allowed under Regulation Z.

“I see that all the time,” he said.

The example should feature conditions consumers would typically receive, Goodman said. Otherwise, presenting a range of outcomes in the example might be safer, he said.