Automakers have used radar in vehicles for more than two decades. But there’s more startups than ever wringing innovation out of that legacy technology.

The latest is Spartan Radar, which closed a $15 million Series A round earlier this week. The round was led by Prime Movers Lab, and it quickly follows a $10 million seed round secured in August.

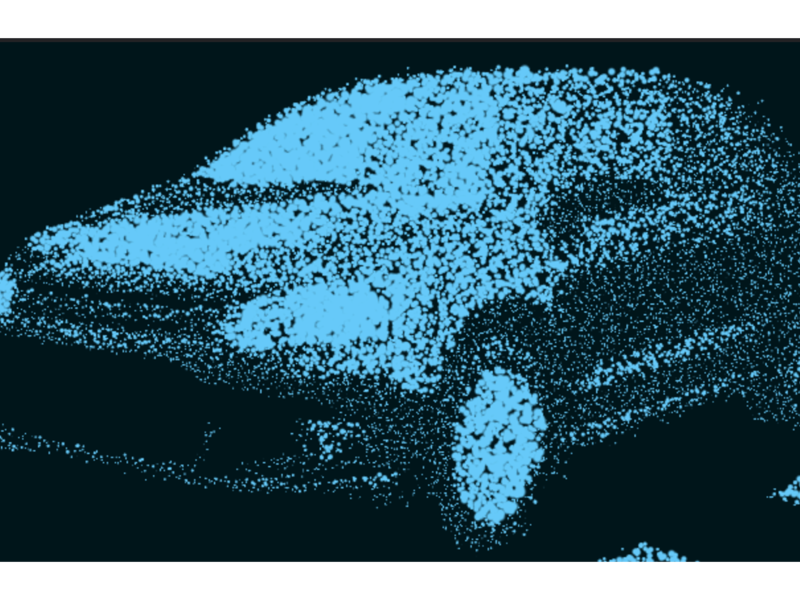

Emerging from the aerospace and defense industries, Spartan Radar executives claim their radar systems make substantial advances in resolution, allowing for lidar-like levels of obstacle detection for driver-assist systems and self-driving vehicles.

The company’s chief product, “Biomemetic Radar,” parallels the manner in which humans perceive and process information. It can lead to a lower rate of false-positive detections, company executives say.

“Spartan Radar’s innovative systems engineering and edge-processing expertise inherently gives the company a strategic advantage,” said Grayson Brulte, a mobility strategist and co-founder of consulting firm Brulte & Co. “The company is extremely well-positioned to capitalize on the growth of autonomy.”

The funding comes at a time when there’s heightened interest and business in extracting more from radar’s role in the suite of sensors that perceive surroundings and enable advanced driving features.

In late October, Ambarella acquired radar-startup Oculii for $307.5 million in an effort to get greater resolution and longer range from current production radar chips. In July, global supplier Magna said it would bring the industry’s first digital lidar units into production on the Fisker Ocean in 2022, in partnership with radar startup Uhnder.

Other key startups pushing radar advances include Lunewave, GPR (formerly WaveSense), Vayyar, Arbe Robotics and many more. Suppliers like ZF and Bosch have internally made strides with radar.

ZF, for one example, launched a mid-range lidar in September intended to boost the performance capabilities of advanced driver-assist systems. Overall, automotive-grade lidar has come a long way since Delphi first introduced it in 1999 on Jaguar models in the 2000 model year.

While radar often complements lidar in terms of overall performance and redundancy, most of the upstarts tout it as an alternative to lidar systems that have historically been expensive, though their cost continues to fall.

But it’s not only cost that gives radar an opportunity to take a more prominent role in the sensor stack.

“Unfortunately, we are seeing evidence that lidar-based systems can behave like the distracted drivers they were intended to replace,” said David Siminoff, general partner at Prime Movers Lab, in written statement. He will join Spartan Radar’s board.

Other investors in Spartan’s Series A round include 8VC and MaC Venture Capital.